Long Call Calendar Spread

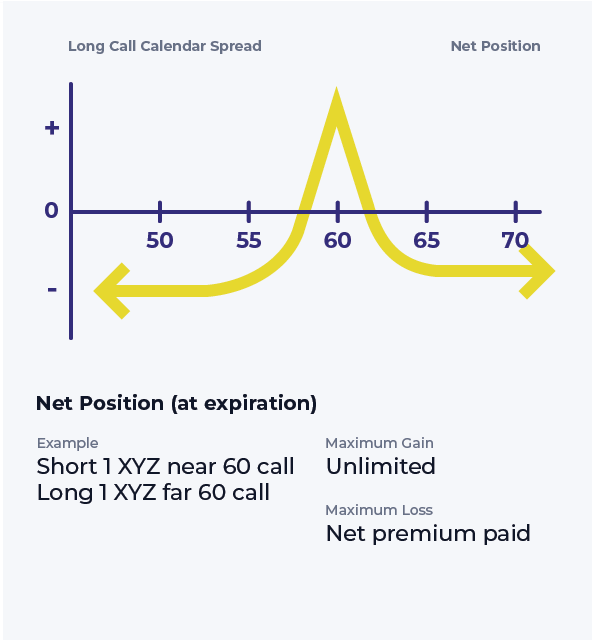

Long Call Calendar Spread - Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar call spread is seasoned option strategy where you sell and buy same strike. Long call calendar spread, also known as call horizontal spread, is a combination of a longer. A long call calendar spread involves buying and selling call options for the same underlying. A long calendar spread is a good strategy to use when you expect the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long call calendar spread can appreciate when the price of the underlying it tracks rises and.

Calendar Spread Using Calls Kelsy Mellisa

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Long call calendar spread, also known as call horizontal spread, is a combination of a longer. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long calendar call spread is seasoned option strategy where.

Calendar Call Spread Options Edge

Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. A long calendar call spread is seasoned option strategy where you sell and buy same strike. Long call calendar spread, also known as call.

Long Call Calendar Spread Options Strategy

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long calendar spread is a good strategy to use when you expect the. Long call calendar spread, also known as call horizontal spread, is a combination.

Calendar Call Spread Option Strategy Heida Kristan

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Long call calendar spread, also known as call horizontal.

Long Calendar Spread with Calls Strategy With Example

A long call calendar spread involves buying and selling call options for the same underlying. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. Calendar spreads are a great way to combine the.

Long Calendar Spreads for Beginner Options Traders projectfinance

Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long calendar call spread is seasoned option strategy where you sell and buy same strike. Long call calendar spread, also known as call horizontal spread, is a combination of a longer. A long call calendar spread involves buying and selling call options.

THE LONG CALL CALENDAR SPREAD EXPLAINED! (EP. 186) YouTube

A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long call calendar spread involves buying and selling.

Long Calendar Spreads Unofficed

Long call calendar spread, also known as call horizontal spread, is a combination of a longer. A long calendar spread is a good strategy to use when you expect the. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. A long call calendar spread involves buying and selling call options for the.

A long call calendar spread involves buying and selling call options for the same underlying. Learn how to create and manage a long calendar spread with calls, a strategy that profits from. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar call spread is seasoned option strategy where you sell and buy same strike. A long call calendar spread can appreciate when the price of the underlying it tracks rises and. Long call calendar spread, also known as call horizontal spread, is a combination of a longer.

Learn How To Create And Manage A Long Calendar Spread With Calls, A Strategy That Profits From.

A long call calendar spread can appreciate when the price of the underlying it tracks rises and. A long calendar spread is a good strategy to use when you expect the. Learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a. A long call calendar spread involves buying and selling call options for the same underlying.

A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike.

Long call calendar spread, also known as call horizontal spread, is a combination of a longer. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.